The scenario:

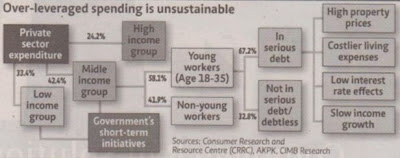

In Malaysia, 24.2% of the households are in the high-income group and 33.4% are in the low-income group and the remaining 42.4% belong to the middle-income group. People in high income spend only a fraction of their income while the low-income group has no money to spend. It is the middle group that spurs the growth of the economy in the country.

Among the middle-income group, 58.1% are young workers between the ages of 18 and 35. Out of which 67.2% are in serious debt. According to the headline in the news, over-leveraged spending is unsustainable.

Why are they in serious debt?

Young workers are impacted by low interest rates because:

· Low-interest rates discourage savings and encourage spending. So young workers choose to spend and overspend and incur more debt.

· Lower interest rates mean lower mortgage repayments. It will spur more borrowing to finance the purchase of houses and inflate property prices.

· Low-interest rates also attract more consumer borrowing.

Young workers also need to spend more because things are costlier than before. The other thing is that their pay increment cannot match additional cash outlay.

According to the same article, rising household indebtedness, rendering them vulnerable to income and interest rate shocks and render the economy and the financial sector more vulnerable to instability and crises.

What can they do?

If they do not take drastic action to manage their personal finance, their outlook is bleak. Here are a few suggestions:

· The way to go is to get out of debt as soon as possible or make debt repayments within their budget. When their monthly spending is under control, it means there will be no more borrowing and they are able to live within their means. It implies that a serious spending cut is crucial to achieving long-term financial freedom.

· Start the habit to save and build an emergency fund so that they are able to cushion in case of a financial crisis.

· Think of unique ideas to create new sources of income. The key is to make changes and improve their financial position.

Current financial situation and its outlook warrant wise management of personal finance to stay afloat.

Related articles:

No comments:

Post a Comment