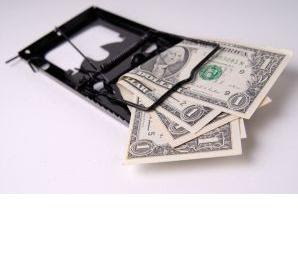

It is unwise in the following situations to obtain credit and get into debt. It will jeopardize your finance during an emergency situation like when you are out of work

1. No regular income: When your income fluctuates from month to month there is no way to do a budget and include the repayments of the loan into your monthly outlay. It is also unlikely for you to obtain a loan without a regular source of income

2. Not within your budget: Don’t get a loan when there is no extra fund to meet monthly repayments

3. Live a more expensive life style: When you can ill-afford to eat out at high end restaurants and buy branded goods, you still can satisfy your hunger in a less expensive way. The cost of branded goods includes frequent advertisements and a higher margin for profit. A less expensive brand is just as good without the high cost of advertisement and lower profit margin.

4. Replacing household items which are still in good working order: When you have the means there is no problem but don’t get a loan to replace electrical appliances or TV which are still in good working conditions.

5. Change a three-year old car to the latest model: The car is in tip-top condition, why raise a loan and incur unnecessary debt and pay interest?

6. Getting things you want: Borrow money to satisfy your ego? It’s stupid thing to do.

7. Sending your children overseas for further education: If it is within your means to study locally why incur a debt to send them overseas? Do you think it is a good thing to pledge your house to finance your children’s education abroad?

8. Throw a party to celebrate an occasion: Who cares about your celebration? Just do it among family members. Don’t get a personal loan just to spend it.

9. Holiday abroad: Have a good time locally instead of getting into debt and paying interest. Malaysia is one of the top ten destinations for holiday makers. Discover more about your own backyard.

10. Renovate your house: Don’t beautify your house when it is in good repair even though the bank encourages you to take a loan as the value of your property has appreciated over time.

The only good thing to raise a loan is to get a roof over your head.

No comments:

Post a Comment